Thinking of publishing a sustainability report this year? To communicate clearly with internal and external stakeholders, a meaningful report should align with industry standards—such as those of the GRI, SASB, the UN SDGs, and/or TCFD recommendations. In fact, according to reports from KPMG and the Government and Accountability Institute, 73% of the G250 (the world’s largest 250 companies) and 52% of the Russell 1000 report in conformance with the GRI Standards—and this number continues to grow.

In October 2021, the Global Reporting Initiative (GRI) unveiled a major update to its disclosure standards. The updated system of GRI Standards now consists of three series of Standards: Universal Standards, Sector Standards, and Topic Standards. The revised standards will become effective January 1, 2023, meaning that any company looking to publish a sustainability report after this date using GRI as a framework should use the updated system of standards.

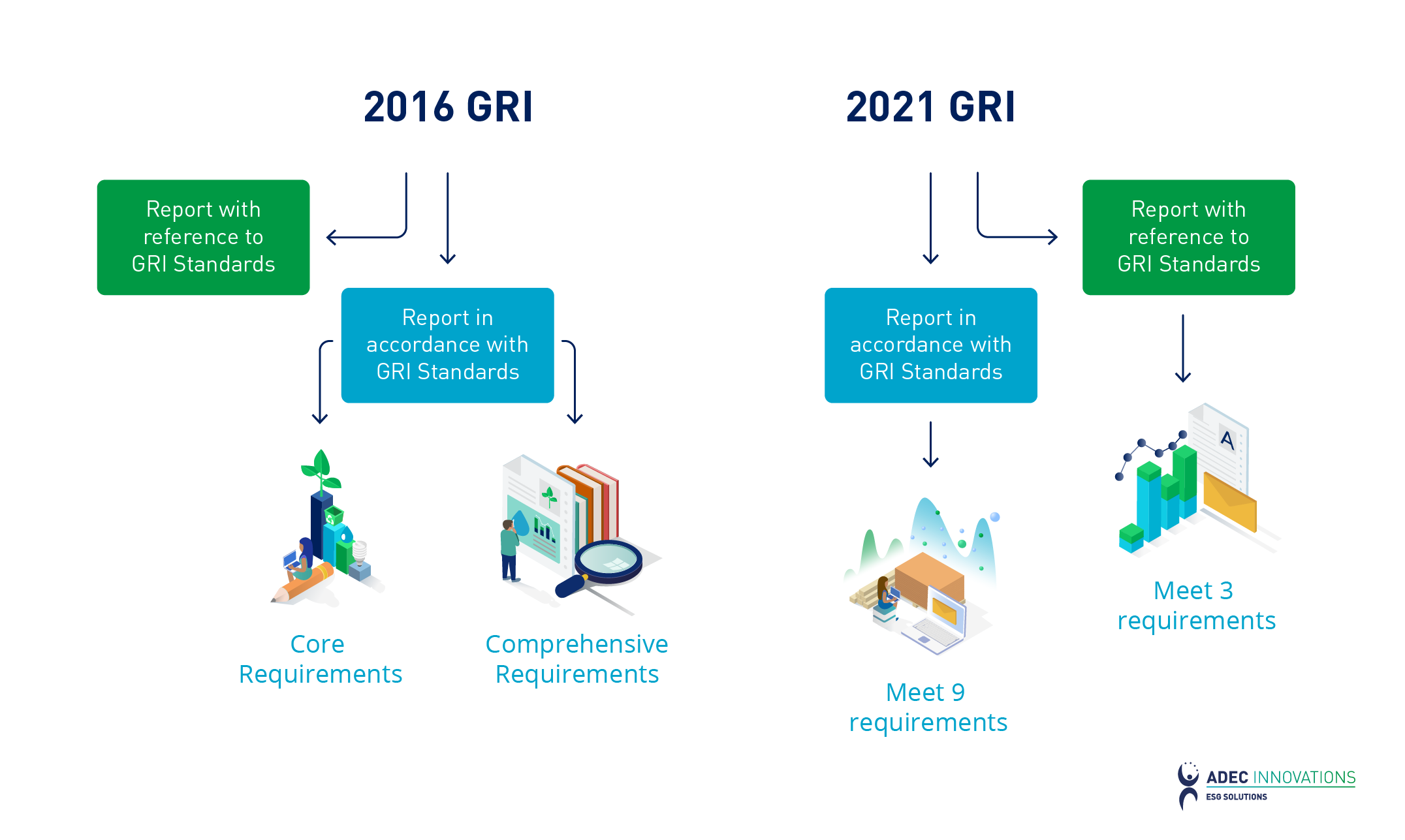

As the most significant update since 2016, the revised standards include clarified guidance on disclosure of material topics, consolidation and streamlining of certain disclosure topics, as well as revised approaches to reporting. Though GRI has announced a handful of big changes, our three-part series will focus on three key changes that are expected to shift the foundation of a disclosing company’s reporting approach.

The change: Elimination of Core and Comprehensive options

With the 2021 revision, companies no longer have the option of selecting a level of thoroughness regarding their disclosure. Now, companies may state that their disclosure is in accordance with the GRI Standards only if they have fulfilled the nine listed requirements (see table below).

Source: GRI Universal Standards 2021 Frequently Asked Questions (FAQs)

If a company is unable to comply with all requirements for reporting in accordance with the GRI Standards, the company may want to consider the with reference route, which has fewer and less intensive requirements.

What this means for reporting companies

How do you decide which route is the most suited for your reporting needs? To answer this question, companies should consider what is driving their reporting efforts.

For example, more regulators and jurisdictions are requiring disclosures on specific topics, such as information on energy and emissions management as part of climate change regulation. If your company’s reporting is driven by such requirements, the with reference route may be sufficient. GRI can provide useful guidance on the metrics and information to disclose on this specific topic, but using the entire GRI framework and standards may not be necessary.

On the other hand, if reporting is driven by investor and stakeholder interest, the in accordance option is a strategic way to provide a “comprehensive picture of the organization’s most significant impacts on the economy, environment, and people, including impacts on their human rights, and how it manages these impacts” (GRI 1: Foundation 2021). Although the high level of transparency and commitment inherent to the in accordance option may seem like a daunting task, this route provides value to the organization beyond transparency. The disclosure requirements outline the trajectory of the ESG space, such as the re-evaluation of materiality, the use of sector-specific topics and metrics to provide context and comparability, and an enhanced focus on governance and the role of high-level governance positions enabling and overseeing corporate strategy. As such, the in accordance requirements provide an opportunity for companies to proactively prepare for the future landscape of ESG by taking another look at their own corporate ESG practices and assessing their gaps with a comprehensive ESG strategy. In practice, the previous core option created “tiers” of transparency across reporting companies, as some companies chose to disclose the minimum requirements while others exceeded the minimum. The new in accordance option removes these tiers to create a single, standard way to disclose a company’s impacts and approach to management, enabling better comparability for stakeholders.

Although the ESG landscape is constantly evolving, recent shifts among regulators and investors make one thing clear: sustainability and accountability are no longer optional.

Read part two of our series, GRI Standards Revisions Part 2: How Do the New Universal Standards Align?

Want to learn more about how ADEC ESG can help your company take its reporting programs and strategy to the next level? Click here to check out our Disclosure and Reporting team and reach out for more info on our tailored solutions.